Van Insurance for Over 50s: FAQs & Key Insights

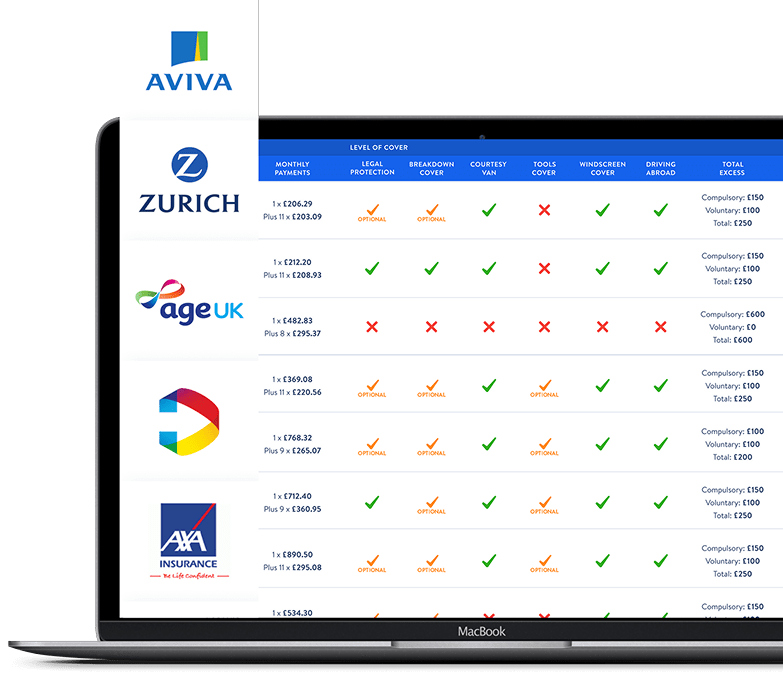

Over 50s van insurance is designed for drivers aged 50 and above. These policies often come with lower base premiums because mature drivers are seen as lower risk, while still offering flexible cover options and popular add-ons. They can be used for business or personal purposes depending on the policy chosen.

- Lower accident rates – statistically, drivers over 50 are less likely to make claims.

- Stable driving history – many have decades of no-claims discounts.

- More predictable usage – lower mileage, limited commuting, or mainly leisure driving can all reduce premiums.

Insurers pass on these savings in the form of cheaper premiums, provided the driver’s record supports it.

Van insurers calculate premiums by analysing:

- Driver characteristics – age, profession, claims history and location.

- Vehicle details – age, model, value and security features.

- Driving behaviour – mileage, usage type, and even telematics data in some cases.

They use large datasets and actuarial models to compare policyholders against historical data, predicting the likelihood and potential cost of future claims. Premiums are then adjusted to reflect this risk profile.

This type of policy is particularly suitable for:

- Retirees who use vans for leisure, hobbies, or family purposes.

- Part-time traders who still work occasionally but drive less.

- Full-time professionals over 50 who want comprehensive protection with tailored pricing.

| Cover Type | What it Includes | When to Use |

|---|---|---|

| Third Party Only | Covers others’ vehicles and property. | Legal minimum; not usually recommended for higher-value vans. |

| Third Party, Fire & Theft (TPFT) | Adds cover for fire and theft. | Often offered to drivers of older vans. |

| Comprehensive | Covers your van as well as others. | Best for newer or higher-value vans, or for full peace of mind. |

Insurer practice can vary depending on the vehicle.

- Some insurers only offer comprehensive cover for newer or higher-value vans.

- Older, lower-value vans may only be eligible for TPFT cover.

- Windscreen and glass protection.

- Breakdown assistance, especially for longer journeys.

- Courtesy van cover while repairs are carried out.

- No-claims bonus protection, useful for those with a long record of safe driving.

- Tool insurance, if the van is used for trade.

Often, but not guaranteed. Premiums are influenced by driving record, vehicle type, location, and claims history.

Yes. Being self-employed does not prevent you from holding a policy that covers only private use, provided you are not using the van for work.

Not usually. Instead, insurers adjust pricing and eligibility criteria based on age and risk profile, which means drivers over 50 often benefit from lower premiums.

Yes. Compulsory excess may vary between Third Party Only, TPFT, and Comprehensive policies, depending on the insurer.

- Use secure parking (driveway, garage or compound).

- Keep annual mileage realistic and as low as possible.

- Install tracking devices or alarms to reduce theft risk.

- Protect your no-claims bonus by avoiding small claims.

- Compare policies annually to keep pace with market changes.

All van insurance policies must meet the minimum requirements of the Road Traffic Act 1988 and be sold in line with FCA regulations. Age can influence premiums, but eligibility still depends on the driver’s record and how the van is used.

Van insurance for over 50s often comes at a lower cost thanks to experience, safer driving habits and long-standing no-claims records. Insurers set premiums by analysing driver characteristics, vehicle details and driving behaviour against large datasets of historical claims. Policies can be tailored to cover business or personal use, with extras such as windscreen cover, breakdown support and no-claims protection proving especially popular. While age can work in your favour, comparing policies each year is the best way to ensure you receive the most appropriate deal.

Get a quote in

Get a quote in

Expert UK team

Expert UK team